- QatarEnergy selects Nakilat to own and operate 25 conventional LNG vessels

- The joint development of the Dorra field between Saudi Arabia and Kuwait is pending the demarcation of the border with Iran

- Minister of Energy reaffirms the UAE’s commitment to adopting clean energy and supporting the Paris Agreement

- The new Hassi Messaoud refinery enjoys the support of the government and President Tebboune

- Increasing electrical interconnection capacities to export electricity beyond borders

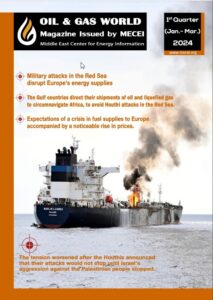

- Qatar Energy stops sending liquefied gas tankers through the Red Sea for security reasons

- The inauguration of the Duqm Refinery, the largest joint Gulf project in the refinery sector

- Saudi oil exports are faltering due to Houthi attacks on ships in the Red Sea and Gulf of Aden

- Algeria to host and chair the Gas Exporting Countries Forum summit (February 29 to March 2, 2024)

- Egypt Energy Conference and Exhibition 2024 gives a strong impetus to the global energy dialogue

Saudi demand optimism lifts oil prices

Prospects for a brief slowdown in U.S. oil production and demand expectations from Saudi Arabia gave oil prices a major lift in Thursday trading.

Ibrahim al-Muhanna, an adviser to the Saudi Petroleum Ministry, said before the Saudi Economic Association in Riyadh the bear market for crude oil was an unnatural and temporary market phenomenon given growth expectations in a recovering global economy.

“I am of the view that the world’s current political, economic or petroleum problems are temporary and their effect on the whole world system is limited,” he said in his address. “In most aspects, especially the economic ones including those of energy and oil, the world is on a progressive track where setbacks are temporary and short-lived.”

At a minimum, he said, oil demand is expected to grow annually by as much as 1 million barrels per day with consumption reaching 105 million bpd by 2025.

Brent crude oil prices gained 1.8 percent from the previous session to trade for $56.58 per barrel. Saudi announcements Wednesday of static oil production drove Brent prices lower and prices for the global benchmark are up less than 1 percent since the start of the week.

The potential of additional Iranian crude oil on the international market added volatility to crude oil prices, struggling to erase the 50 percent loss since June. Crude oil markets are favoring the supply side in part because of increased crude oil production from the United States.

A report this week from the U.S. Energy Information Administration said additional Iranian crude oil next year could erase as much as $15 from the per barrel price for Brent. Shell Chief Executive Officer Ben van Buerden told reporters during a Wednesday conference call it was “very, very early days” for consideration of any Iranian market activity.

“This is not something that is imminent but it is something that is of interest,” he said.

EIA added that lower crude oil prices could slow growth momentum in U.S. shale basins during the second half of the year, softening any supply side concerns.

The price for West Texas Intermediate, the U.S. benchmark, gained just over 1 percent in early Tuesday trading to fetch $51 per barrel.

Source: UPI – April 10, 2015